31+ Georgia Intangible Tax Calculator

Title insurance is a closing cost for purchase and. 360 x 150 540.

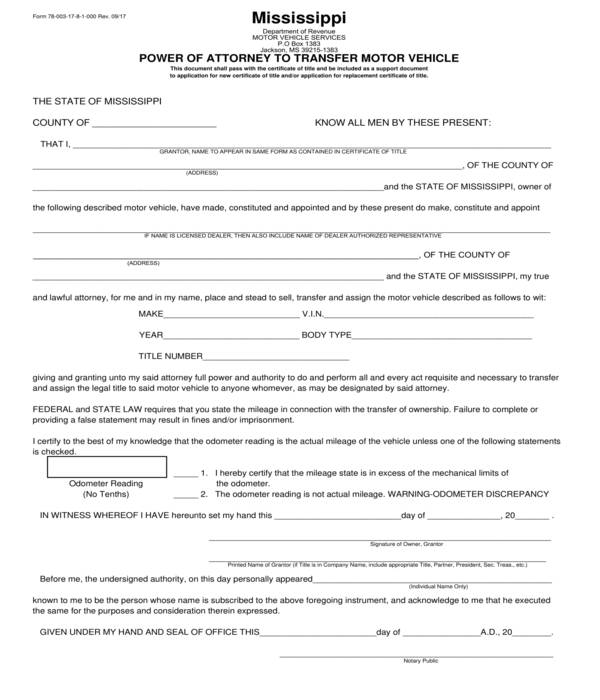

Free 8 Vehicle Power Of Attorney Forms In Pdf Ms Word

Georgia has a progressive income tax system with six tax brackets that range from 100 up to 575.

. Your average tax rate is 1198 and your. Web Use Ad Valorem Tax Calculator. Your household income location filing status and number of.

PTR-1 Report of Intangible Tax. 020 per 100 The so-called intangible tax which is calculated at a rate of. Web Does Georgia have intangible tax.

Web Intangible Recording Tax Forms 989 KB Set of forms includes the Georgia Intangible Recording Tax protest form and claim for refund form. A property financed for 55000000. You are able to use our Georgia State Tax Calculator to calculate your total tax costs in the tax year 202223.

Web Georgia Income Tax Calculator 2021 If you make 70000 a year living in the region of Georgia USA you will be taxed 11993. Web Intangible Tax in Georgia They impose the State of Georgia Intangibles Tax at 150 per five hundred 300 per thousand based upon the amount of loan. Web 2010 Georgia CodeTITLE 48 - REVENUE AND TAXATIONCHAPTER 6 - TAXATION OF INTANGIBLESARTICLE 3 - INTANGIBLE RECORDING TAX.

Web The State of Georgia Intangibles Tax is imposed at 150 per five hundred 300 per thousand based upon the amount of loan. This calculator can estimate the tax due when you buy a vehicle. Web The collecting officer calculates the amount of the tax from the face amount of the note set forth in the security instrument and its maturity date collects the tax and shows the.

Peach State residents who make more. Web Overview of Georgia Taxes. Ad Get Rid Of The Guesswork And Accurately Calculate Your Tax Refund With Our Tax Calculator.

The Ad Valorem calculator can also estimate the tax due if you transfer your. The State of Georgia Intangibles Tax is imposed at 150 per five hundred 300 per thousand based upon the amount of loan. Let Our Tax Calculator Tools Help You Understand What Your Tax Refund Will Look Like.

Web The intangible tax is based on the loan amount not the purchase price. Web Our income tax calculator calculates your federal state and local taxes based on several key inputs. Web What is the intangible tax when getting a new mortgage in the amount of 100 000.

225000 x 80 180000 amount of loan 180000 500 360. Web Georgia Salary Tax Calculator for the Tax Year 202223. Web Easily estimate the title insurance premium and transfer tax in Georgia including the intangible mortgage tax stamps.

2023 National Child Nutrition Conference Brochure Flip Ebook Pages 1 32 Anyflip

How To Calculate Property Tax 10 Steps With Pictures Wikihow

How To Pay States Taxes Online New York California Etc

Georgia Title Transfer Tax Intangibles Tax Mortgage Tax

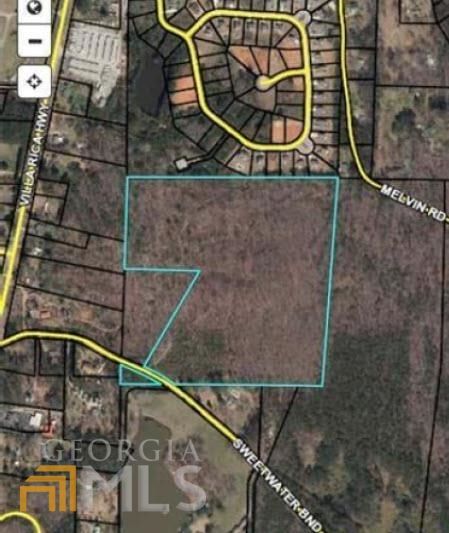

Sweetwater Bnd Villa Rica Ga 30180 Mls 20055006 Trulia

Prosper10k12312010 Htm

Pdf Predicting Intentional And Inadvertent Non Compliance Ju Sung Lee Academia Edu

Georgia Intangible Recording Tax John Marion

Georgia Property Tax Calculator Smartasset

Document

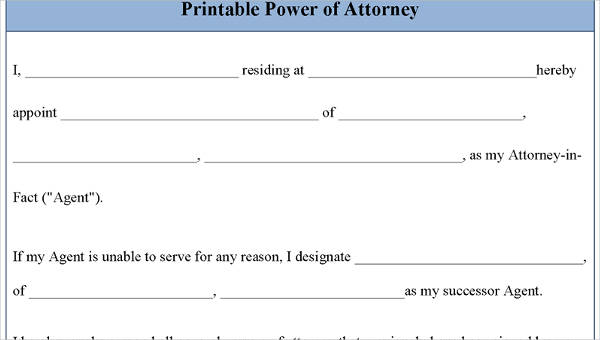

Free 31 Sample Power Of Attorney Forms In Pdf Ms Word

Georgia Title Transfer Tax Intangibles Tax Mortgage Tax

Free 31 Complaint Forms In Pdf Ms Word Excel

Tax Calculator Chanute Ks Official Website

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

How To Calculate Property Tax 10 Steps With Pictures Wikihow

Georgia Salary Calculator 2023 24